Pet insurance is crucial for your pet’s health and your peace of mind. But did you know that breed-specific coverage can make a significant difference?

Every pet breed has unique health needs. Some breeds are prone to specific conditions, while others may have fewer health issues. Understanding these needs helps you choose the best insurance for your pet. Breed-specific coverage ensures that your pet gets the right care tailored to its breed.

This specialized insurance can save you money and provide better care for your furry friend. Let’s dive into why breed-specific coverage is important and how it can benefit you and your beloved companion.

Credit: justoborn.com

Introduction To Breed-specific Coverage

Every pet is unique. Each breed has its own characteristics, health needs, and risks. Breed-specific coverage is a way to ensure your pet gets the best care. This type of insurance tailors its policies to the specific needs of different breeds.

What It Means

Breed-specific coverage means your pet insurance is customized. It considers the common health issues of your pet’s breed. For example, some dog breeds are prone to hip dysplasia. Others may have heart conditions. This type of coverage ensures that these specific issues are addressed.

It involves understanding the medical history of different breeds. Insurers create policies that cover the common health problems. This way, your pet receives the care it needs without unexpected costs.

Importance For Pet Owners

Having breed-specific coverage is crucial. It ensures your pet gets the right care. This coverage can save you money. General insurance might not cover breed-specific issues. This leads to high out-of-pocket costs for treatments.

It also offers peace of mind. You know that the common health problems of your pet’s breed are covered. This means fewer surprises and better care for your furry friend.

Moreover, it allows you to plan better. You can budget for your pet’s health needs more accurately. This type of insurance provides a tailored approach. It matches your pet’s unique health profile.

| Breed | Common Health Issues | Coverage Benefits |

|---|---|---|

| German Shepherd | Hip Dysplasia, Elbow Dysplasia | Specialized treatments and surgery coverage |

| Bulldog | Respiratory Issues, Skin Problems | Chronic condition management |

| Golden Retriever | Heart Conditions, Cancer | Comprehensive illness coverage |

With breed-specific coverage, you can focus on enjoying time with your pet. You don’t have to worry about unexpected health issues. This type of insurance is a smart choice. It provides the best care tailored to your pet’s needs.

Credit: www.marketdataforecast.com

Benefits Of Breed-specific Pet Insurance

Breed-specific pet insurance offers many advantages tailored to your pet’s unique needs. It ensures your furry friend gets the best care possible. Let’s explore the key benefits of breed-specific pet insurance.

Customized Care

Different breeds have different health concerns. Breed-specific insurance covers these unique needs. For example, Bulldogs often face respiratory issues. Siamese cats may have dental problems. With customized care, your insurance covers treatments specific to your pet’s breed.

Customized care also includes preventive measures. Regular check-ups and screenings can catch issues early. This leads to better health outcomes for your pet.

Cost Efficiency

General pet insurance may cover things your pet never needs. Breed-specific insurance focuses on relevant issues. This can lower your premiums. You only pay for what your pet might actually need.

Here’s a breakdown of how cost efficiency works:

| General Pet Insurance | Breed-Specific Insurance |

|---|---|

| Covers all breeds | Covers specific breeds |

| Higher premiums | Lower premiums |

| Broad coverage | Focused coverage |

With focused coverage, you avoid paying for unnecessary services. This makes breed-specific insurance more cost-efficient.

In summary, breed-specific pet insurance offers customized care and cost efficiency. It ensures your pet gets the care they need without extra costs.

Common Health Issues By Breed

Every dog breed has its own set of common health issues. Some breeds are more prone to specific conditions due to their genetics. Knowing these issues can help you choose the right pet insurance. Breed-specific coverage ensures your unique companion gets the care they need.

Genetic Disorders

Some breeds have genetic disorders that can affect their health. For example, German Shepherds often face hip dysplasia. This condition can cause pain and mobility issues. Bulldogs may suffer from brachycephalic syndrome. This can lead to breathing problems. Knowing the genetic risks of your breed helps in planning better care.

Chronic Conditions

Many breeds are prone to chronic conditions. Poodles often develop Addison’s disease. This affects their adrenal glands. Boxers may deal with heart issues like cardiomyopathy. Regular vet visits are crucial for managing these conditions. Pet insurance that covers chronic issues can save you from high vet bills. It also ensures your pet gets the continuous care they need.

Choosing The Right Policy

Choosing the right pet insurance policy can feel overwhelming. Different breeds have unique needs and potential health issues. Tailoring coverage to match your pet’s breed ensures they get the best care possible. Here’s how to navigate the options.

Evaluating Coverage Options

Start by looking at what each policy covers. Some policies offer broad coverage. Others focus on specific conditions or treatments. Compare the details. Look for policies that address common issues for your pet’s breed.

Check the limits on coverage. Some policies have annual or lifetime caps. Make sure the limits are enough for your pet’s needs. Also, see if the policy covers routine care. Vaccinations and check-ups can add up. A policy that includes these can save money.

Understanding Exclusions

Read the fine print. Every policy has exclusions. These are conditions or treatments the policy won’t cover. Knowing these helps avoid surprises. Some breeds are prone to genetic conditions. Ensure the policy does not exclude them.

Check the waiting periods. Many policies have a waiting period before coverage starts. Understand how long you need to wait. Also, see if there are any age limits. Some policies exclude older pets. Choose a policy that fits your pet’s age and health status.

Top Insurance Providers

Finding the right pet insurance can feel overwhelming. Each breed has specific needs. Understanding top insurance providers can help you make an informed choice. Below, we explore the leading companies and compare their plans.

Leading Companies

Several companies stand out for their breed-specific coverage. They offer tailored plans to meet the unique needs of different pets. Here are some of the top providers:

- Healthy Paws: Known for comprehensive coverage and quick claim processing.

- Embrace: Offers customizable plans and wellness rewards.

- Nationwide: Provides a variety of plans, including exotic pets.

- Petplan: Covers hereditary and chronic conditions.

Comparison Of Plans

Each insurance provider offers various plans. Comparing them helps you find the best fit for your pet’s needs. Below is a table comparing key features of top plans:

| Provider | Coverage | Annual Limit | Deductible | Reimbursement |

|---|---|---|---|---|

| Healthy Paws | Accidents, Illnesses | Unlimited | $100 – $500 | 70% – 90% |

| Embrace | Accidents, Illnesses, Wellness | $5,000 – $15,000 | $200 – $1,000 | 70% – 90% |

| Nationwide | Accidents, Illnesses, Wellness | $10,000 | $250 | 50% – 90% |

| Petplan | Accidents, Illnesses | Unlimited | $250 – $1,000 | 70% – 90% |

Choosing the right plan depends on your pet’s breed and health needs. Consider coverage details, annual limits, deductibles, and reimbursement rates. This helps ensure your pet receives the best care possible.

Credit: alpinehospital.com

Real-life Success Stories

Real-life success stories provide insight into the impact of breed-specific coverage. These stories highlight how tailored pet insurance helps pets and their owners. From unexpected illnesses to routine care, pet insurance can make a difference.

Case Studies

Let’s look at a few case studies. Bella, a French Bulldog, suffered from a genetic disorder. Her insurance covered the expensive treatment. This helped her owner manage costs and focus on Bella’s recovery.

Max, a German Shepherd, had hip dysplasia. His breed-specific coverage included physical therapy. This allowed Max to regain strength and mobility. His owner avoided significant out-of-pocket expenses.

Testimonials

Many pet owners share their positive experiences. Sarah, owner of a Shih Tzu, praises her pet insurance. Her dog needed surgery, and the insurance covered most of the costs. Sarah felt relieved and thankful for the support.

John, who owns a Labrador, also shares his story. His dog had chronic ear infections. The breed-specific coverage included treatments and check-ups. John found the insurance invaluable for his pet’s health.

Cost Factors To Consider

Choosing the right pet insurance for your unique companion can be challenging. There are many cost factors to consider. Understanding these can help you make an informed decision. This section covers important aspects like premiums, deductibles, and hidden fees.

Premiums And Deductibles

Premiums are the monthly or yearly payments you make for your pet insurance. These can vary based on your pet’s breed, age, and health. It’s essential to compare different plans and their premiums. Some breeds may have higher premiums due to common health issues.

Deductibles are the amount you pay out of pocket before your insurance kicks in. There are two types of deductibles:

- Annual Deductibles: You pay once per year, regardless of the number of claims.

- Per-Incident Deductibles: You pay for each separate claim you make.

Choosing the right deductible can impact your overall costs. A lower deductible usually means higher premiums. Conversely, a higher deductible can lead to lower premiums. Evaluate your pet’s health needs and your budget to find the best balance.

Hidden Fees

Pet insurance policies may include hidden fees. These can significantly affect your overall costs. Some common hidden fees include:

- Enrollment Fees: One-time fees when you first sign up.

- Processing Fees: Charges for handling your claims.

- Exclusion Costs: Fees for conditions not covered by the policy.

It’s important to read the fine print and ask questions. Ensure you understand all potential fees before committing to a plan. This can help you avoid unexpected expenses and make a well-informed decision for your pet’s health insurance.

Future Trends In Pet Insurance

Pet insurance is evolving rapidly. This evolution benefits pet owners and their unique companions. Future trends in pet insurance show promising developments. These trends will cater to the diverse needs of different breeds. Let’s explore these future trends and how they can impact you and your pet.

Technological Advances

Technology is transforming pet insurance. Smart devices track pet health data. Insurers use this data to create personalized plans. Artificial intelligence (AI) helps predict health issues. This can lead to early intervention and better care. Telemedicine is another growing trend. It allows pet owners to consult vets online. This is convenient and reduces stress for pets. Wearable tech devices are becoming popular. They monitor activity levels and vital signs. This data helps in tailoring insurance coverage.

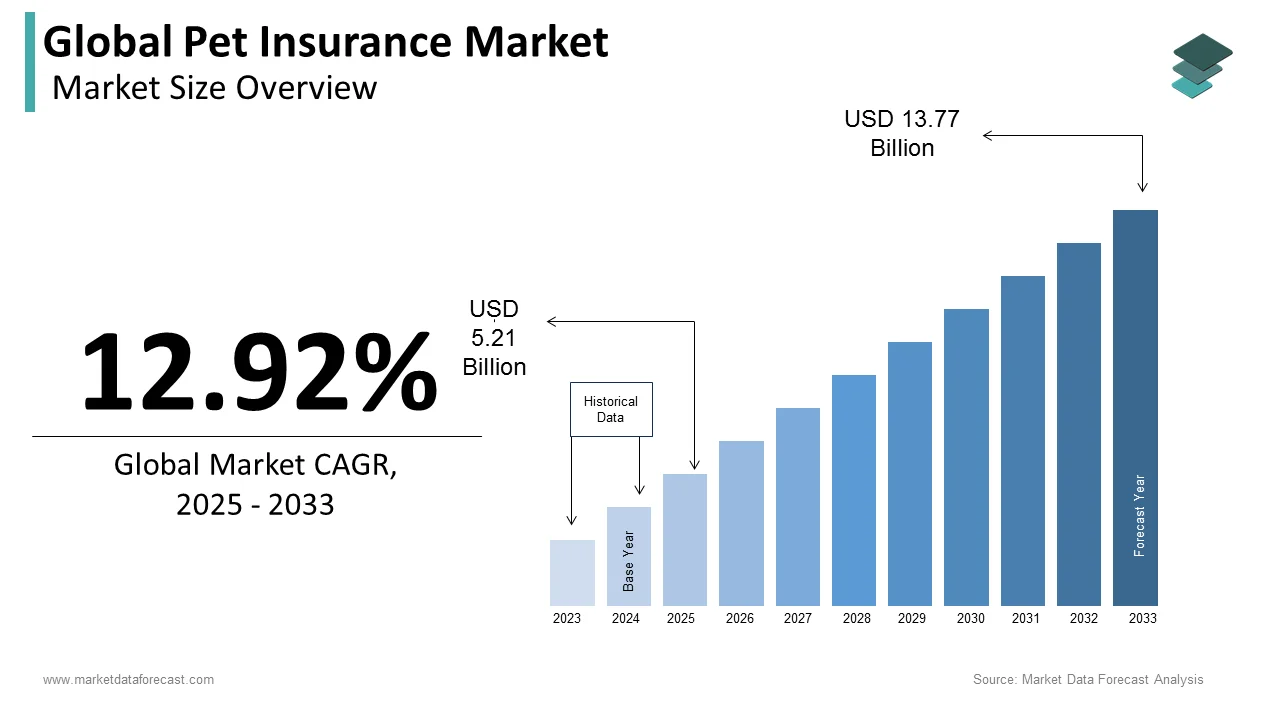

Market Growth

The pet insurance market is expanding. More pet owners are buying insurance. They want to ensure the best care for their pets. Insurance companies are offering more tailored plans. These plans cater to specific breeds and their needs. Competition among insurers is increasing. This leads to better services and lower premiums. The market growth encourages innovation. Insurers are constantly improving their offerings. This benefits pet owners by providing more options.

Frequently Asked Questions

What Is Breed-specific Pet Insurance?

Breed-specific pet insurance tailors coverage to the unique health risks of specific breeds. This ensures better protection and often includes breed-related conditions.

Why Choose Breed-specific Coverage?

Choosing breed-specific coverage ensures your pet is protected against common breed-specific health issues. It offers peace of mind and potentially reduces veterinary costs.

How Does Breed-specific Insurance Work?

Breed-specific insurance evaluates common health issues in your pet’s breed. It then customizes coverage to address those specific concerns.

Is Breed-specific Insurance More Expensive?

Breed-specific insurance can be more cost-effective. It targets common breed health issues, potentially reducing overall veterinary expenses.

Conclusion

Pet insurance tailored to your pet’s breed offers great benefits. It ensures specific coverage based on unique needs. This type of insurance can save you money and stress. Your pet gets the best care possible. Consider breed-specific coverage for peace of mind.

Your furry friend deserves the best protection. Always choose a plan that suits your pet. Tailored insurance means happier and healthier pets. Make an informed choice today.